One key to sound investing decisions is to not over-pay for services. The management expense ratio (MER) is the most important measure of the expense charged by a mutual fund or ETF. We introduce that term, and other fee related concepts, in this posting.

One key to sound investing decisions is to not over-pay for services. The management expense ratio (MER) is the most important measure of the expense charged by a mutual fund or ETF. We introduce that term, and other fee related concepts, in this posting.What is the MER?

This term MER is used for both mutual funds and ETFs. If the MER is 1.00% it means that for every $100 invested in the fund you will pay $1.00 in fees each year. These fees are automatically deducted from the value of the fund, so you won't actually get a bill for these fees. However, a high MER will detract from the return on your investments, perhaps significantly so.Where does the MER go? It provides a salary for the advisor who manages the fund (not to be confused with your personal financial planner), may include the costs associated with buying and selling stocks or bonds in the fund (but see TER below), accounting and reporting costs, legal fees, communication and marketing, and other day to day costs.

Fortunately, MERs have been steadily falling on mutual funds, and to a lesser degree on ETFs where they were already relatively low. With new fee transparency regulations coming into force, it is expected that fees will continue to fall.

How Much is Reasonable?

The obvious question to ask is: How high a MER is reasonable?There is unfortunately no simple answer to this question. A number of mutual funds have MERs of 2% or more, although many financial commentators consider this too high. The lowest ETF MERs are about 0.05%, but these only apply to index ETFs which track a developed stock exchange. For example the iShares XIC and the Vanguard VCN both track the composite main Canadian stock market, and have MER values of 0.06%.

As a general rule, we suggest you question whether you are getting value for your fee especially if a mutual fund MER is much more than 1.0, and if an ETF MER is much more than 0.5. That being said, it is important to realize some investment vehicles have legitimate reasons to charge higher fees. Some of these issues are listed below.

- The lowest MER usually are associated with stock only funds that track the Canadian or US stock markets.

- Bond index funds are also low, but usually not quite as low,

- Passive funds that track an index should, and usually do, have lower MER than active funds where a manager makes decisions on what to hold.

- Generally speaking foreign funds have higher MER.

- Specialized funds with smaller amounts invested have higher MER.

- Also, not unreasonably, funds that pay out monthly income generally have higher MER than those with annual or semi-annual payouts.

- A balanced fund that holds a mix of investment instruments will generally have a slightly higher MER, although there are excellent mutual fund choices around the 1% MER level in this category (we will write about these in a future column).

- Some funds hedge against foreign currency fluctuations, generally at an added cost.

MER vs Management Fee

Many mutual funds report a management fee separate from the MER. The management fee reflects the direct costs of management of the fund, while the MER includes that as well as things like accounting, legal and communication costs as well. In most cases the management fee is most of the full MER, but it will always be at least slightly less. John Heinzl of the Globe and Mail has written a clear article on the difference.What is the TER?

There is also something called the Trading Expense Ratio (TER), that reflects the actual commissions paid as the fund buys and sells stocks, bonds and other financial instruments. This is a bit higher when the fund is active, with more buying and selling, and rebalanced frequently, but in most cases the TER is much less than the MER. In general the TER for mutual funds is not included in the MER, and you will have to dig through the financial records to find it as not all summaries will even show it. Fortunately, the TER is normally much less than the MER, although there are examples, such as covered options funds, where it can be a significant part of the total costs.Royal Bank have a clear statement of management fees, management expense ratio and trading expense ratio for their mutual funds here.

For ETFs some have an additional TER, while others include it in an all-inclusive MER. Fortunately, the largest provider of ETFs in Canada, iShares, do include it in the MER.

If you do need to determine the TER, it takes a bit of digging, but John Heinzl leads you through the process here, using the resources from http://sedar.com.

Finding MER Information

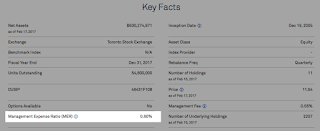

Fortunately, it is very easy to find the MER for any mutual fund or ETF. One way is to go to a resource such as https://www.morningstar.ca/, find the mutual fund or ETF from its name or code, and then use the Quote tab. The MER will be shown near the right top of the information provided.Alternatively you can go to the website of the ETF or mutual fund. This is shown for the iShares XTR ETF below, with the MER highlighted.

|

| Showing MER information for iShares XTR. |

Don't Forget Other Costs

While for long term holdings the MER will be the dominant cost, there are additional costs.- For ETFs there is the commission charged by the broker to buy and sell the ETF units.

- Also, there may be foreign currency fees if the ETF is in US dollars, or at least a small foreign currency buy and sell rate difference.

- While not a fee per se, the difference between what an ETF sells at and buys for may be significant in low volume ETFs.

- For mutual funds there may be initial or trailing fees, or some other commission.

- If you have a fee-only financial planner, their fees will be in addition to the mutual fund (or ETF) fees.

An Example

Let's see how the fees work with a realistic example.Assume that you have a discount broker that charges $10 commission for each trade (for simplicity of calculation we assume that this is the cost with taxes included). If you bought $10,000 of the XTR ETF five years ago, held it for those five years reinvesting all gains in the XTR through a no-cost DRIP program, and then resold the units, how much would you have paid in fees?

The MER for this fund (see above) is currently 0.60%, and for this simplified example we assume that was constant over the entire period (MER rates usually only slightly change from year to year).

The 5 year performance for this ETF according to morningstar.ca is an annual average of 4.70% (that is based on NAV, or net asset value, which takes into account both dividend payouts and change in the value of the ETF - more on this in a later column). For simplicity in this calculation we will assume that the performance has been constant in each of the years, although of course it is not at all constant.

The actual situation would have different fees and performance in each year, but the final results should be only slightly different from that shown here. XTR is an instrument usually used for regular income, but we assume that all income generated by the fund is put back into reinvestment of the fund for purposes of this example.

Because of the assumed $10 trading commission, we would only have $9990 to invest, as shown in the end of year 0 value in the table. After the first year we assume that the investment value has increased by 4.70%. The MER of 0.60% on this value indicates that we paid $62.70 in ETF fees. We don't subtract that from the $10459.53, since the MER is already calculated into the quoted performance figures.

We extend similar analysis for each of the four other years, and then incur another commission charge of $10.00 when we sell the ETF.

Overall with the assumptions made you would have gained about $2558 on your original $10,000 investment, having paid about $365 in fees, including both the MER of the fund and the trading commission of your broker.

It is important to note that while we selected a specific ETF, and simplified with approximations like a constant return each year, this should not be taken as a detailed analysis of the XTR ETF.

Final Thoughts

We will have much more on fees in future columns. If we had held similar stocks and bonds to the ETF used in the example in a balanced mutual fund which charged a MER of 2.4% (near the upper end of mutual fund fees), we can see that nearly half of the total investment return would have been absorbed by fund fees. If a fee-only advisor had charged an additional fee of 1 or 1.5% for their services, we could be in a situation where the majority of the investment gain is taken up with fees.As in most consumer choices, the cheapest investing vehicle is not necessarily the best one. We should however, know what fees we are paying, and see if they are competitive with alternatives.

This posting is intended for education only. The reader is responsible for their own financial decisions. The writer is not a financial planner and reading this column should not be interpreted as obtaining individual financial planning advice. For major financial decisions it is always wise to consult skilled financial professionals. While an effort has been made to be accurate, any statements of fact should be independently checked if important to the reader.

Disclosure: The author of this column holds funds in the ETFs mentioned in this column (XIC, VCN, XTR).

Thanks you very much for sharing. You always try to sharing such a good android apps with us.

ReplyDeleteMy Expense Manager Android Apps

Android App Development Company in Delhi