It is generally agreed that Canadian stocks should be a core component of a Canadian portfolio. For most individual investors, rather than holding those stocks directly, it makes sense to use an ETF.

Another option would be Canadian stock index mutual funds, but that will result in a higher MER. If you don't want to bother with a discount brokerage account, mutual funds might still be a good option for you. Also, if you are funding your investments in small amounts at a time, mutual funds will avoid the discount brokerage commissions on ETF purchases. We will cover Canadian stock index mutual funds in a future post.

Another option would be Canadian stock index mutual funds, but that will result in a higher MER. If you don't want to bother with a discount brokerage account, mutual funds might still be a good option for you. Also, if you are funding your investments in small amounts at a time, mutual funds will avoid the discount brokerage commissions on ETF purchases. We will cover Canadian stock index mutual funds in a future post.

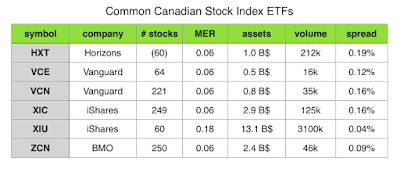

Fortunately, there are a number of great Canadian stock ETFs with very low management expense ratios (MER). At the time we are writing this (early March 2017) the information on the most popular choices in this category are given in the following table (click on it to make the image easier to read).

The Toronto Stock Exchange (TSX) actually has two branches. the main TSX which with 1561 companies listed, and a venture category for smaller and newer companies, that as of the time of writing, had 2424 listed companies. You might be surprised by these numbers, since most financial news talks about either the TSX composite, that contains about 250 of the larger companies from the entire TSX, or the TSX 60 which, as the name implies, is the 60 largest companies. As companies grow, or reduce in net worth, the exact companies on the two lists change slightly from time to time.

Is it better to hold an ETF that tracks the TSX 60 or the TSX composite? The advantage of the TSX 60 is that they are all large, for the most part very stable and well established, companies. This is very much a 'blue chip' list, and most of the companies are household names. It is important to realize that the TSX, and especially the TSX 60, is far from diversified, however. For example, at the current time the three largest companies are all banks (Royal, Toronto Dominion and Bank of Nova Scotia), and together they account for almost 24% of the entire TSX 60 value! Even in the broader TSX composite, these three companies represent nearly 18% of the index value.

The main Canadian stock ETFs track either the TSX 60 index or the TSX composite index. From the ETFs shown in the table, VCN, XIC and ZCN track the composite index (or a slight alteration of it), while HXT, VCE and XIU track the TSX 60. As you can see, competition in this investing space has resulted in very low and similar MER of 0.06 on most products (XIU being the exception).

If MER is not a distinguishing characteristic, how do you choose between the ETF options? The simple answer is that the products are very similar, will yield nearly the same performance, and really you should not worry too much about which to choose.

There is one significant difference between HXT and the other offerings in the table, however. All of the others hold the actual TSX stocks. That is, they take the funds invested in the ETF, and then buy proportionately the different stocks in the index. The down side of this is that when the index changes, the fund will need to do a bit of buying and selling, triggering some capital gains, and for short periods of time drifting very slightly from the index. The plus side, though, is that you really are owning the actual stocks by holding the ETF.

The HXT product is an example of what is called a swap-based ETF. Rather than buying the stocks, it gives the money to a bank that agrees to return to HXT the return of the TSX index over the period of time. The process is well explained in this post from the Canadian Couch Potato site (note the MERs have changed in the several years since that post was written, but the explanation of how the swap works is still valid).

There is an important tax (and income) difference that should be understood as you make the choice between HXT and one of the other Canadian index ETFs. No dividends are paid by HXT, although they are worked into the appropriate changing price of the ETF. This means that swap based products are not good choices when you want a regular income stream. There is a potential tax advantage, though, in that you do not need to pay annual tax on dividends earned. It is important to realize that you will still be taxed, but as a capital gain when you sell your units of HXT. What you are really doing is deferring the tax, and it will appear as a later capital gain rather than as a regular annual dividend. Whether this is a positive or negative will depend on your personal financial situation. Swap based products are good if your income from other sources is variable, and you can cash in the HXT units in a tax year when your other income is relatively low.

For any ETF, a consideration is how widely traded the product is. We have shown (using data from morningstar.ca) the mean daily volume of each ETF. For example, the mean number of units of HXT that traded in a day were 212000 (we have written this as as 212k, with k meaning thousands, in the table). We also show the total assets held in each of the ETFs - e.g. ZCN has about 2.4 billion dollars invested in the fund. Both of these numbers will change over time, so you should check for current values if this information is important to you. These are all pretty widely held, however, and the concerns about specialized ETFs that are only lightly traded do not hold for any of these products.

I have also included in the table (using morningstar.ca data) the spread between the mean ask price at which the ETF is offered for sale, and the price being bid by someone looking to purchase the ETF. A smaller spread is desired, since that implies it will be easier to quickly buy or sell the ETF without paying a premium on the transaction. Naturally widely held ETFs with high daily trading volume are generally expected to have a lower spread. The figures here represent a snapshot at the time I am writing this post, and would change from day to day according to overall trading volume and other factors. By showing patience and using limit orders you can usually get a stock or ETF at a fair price.

I have also included in the table (using morningstar.ca data) the spread between the mean ask price at which the ETF is offered for sale, and the price being bid by someone looking to purchase the ETF. A smaller spread is desired, since that implies it will be easier to quickly buy or sell the ETF without paying a premium on the transaction. Naturally widely held ETFs with high daily trading volume are generally expected to have a lower spread. The figures here represent a snapshot at the time I am writing this post, and would change from day to day according to overall trading volume and other factors. By showing patience and using limit orders you can usually get a stock or ETF at a fair price.

Some of these products have been around much longer than others - e.g. iShares XIU entered the Canadian ETF space earlier, as one of the first Canadian ETFs, and that largely accounts for the fact it has much more money in assets.

If you use Scotia iTRADE as your discount brokerage, HXT can be bought and sold without commission. I believe that QTrade Investor and Virtual Brokers also offer HXT without commission, but check with them to be sure.

Personally I prefer the slightly broader holdings of the composite index. Within that space I see little difference between VCE, XIC and ZCN - I personally use XIC, but that is mainly because I was invested in XIC units before the other two started operation. I do like for some accounts (e.g. my TFSA) the swap based HXT. Also if I am investing in small amounts. I use HXT since it is commission free in my Scotia iTRADE account.

There are a number of other ETFs that operate in the Canadian equity index space, and we may cover some of them in future posts. For most investors, however, we feel that one or more of the options shown in the table would well serve your needs.

You should discuss with your investment advisor which of these products are best for you, and have her/him explain in more detail the implications of swap-based vs. directly held ETFs. Your investment advisor can also help you determine how much of your portfolio to hold in Canadian equity ETFs or mutual funds.

Before ending this posting I want to stress how incredibly low the MER are for these products. You can have $10000 invested across about 250 different companies in the composite TSX index, and your annual fees are $6.00. That is truly good news for investors!

Personally I prefer the slightly broader holdings of the composite index. Within that space I see little difference between VCE, XIC and ZCN - I personally use XIC, but that is mainly because I was invested in XIC units before the other two started operation. I do like for some accounts (e.g. my TFSA) the swap based HXT. Also if I am investing in small amounts. I use HXT since it is commission free in my Scotia iTRADE account.

There are a number of other ETFs that operate in the Canadian equity index space, and we may cover some of them in future posts. For most investors, however, we feel that one or more of the options shown in the table would well serve your needs.

You should discuss with your investment advisor which of these products are best for you, and have her/him explain in more detail the implications of swap-based vs. directly held ETFs. Your investment advisor can also help you determine how much of your portfolio to hold in Canadian equity ETFs or mutual funds.

Before ending this posting I want to stress how incredibly low the MER are for these products. You can have $10000 invested across about 250 different companies in the composite TSX index, and your annual fees are $6.00. That is truly good news for investors!

This posting is intended for education only and should not be considered investment advice. The reader is responsible for their own financial decisions. The writer is not a financial planner or investment advisor, and reading this column should not be interpreted as obtaining individual financial planning or investment advice. For major financial decisions it is always wise to consult skilled professionals. While an effort has been made to be accurate, any statements of fact should be independently checked if important to the reader.

Disclosure: The author of this column holds the following ETFs mentioned in this article in one or more account: HXT, VCN, and XIC. I also use Scotia iTRADE discount brokerage services. No compensation by any company has been offered, requested or received for writing this column.

The current MER on HXT has been lowered to 0.03%!

ReplyDelete